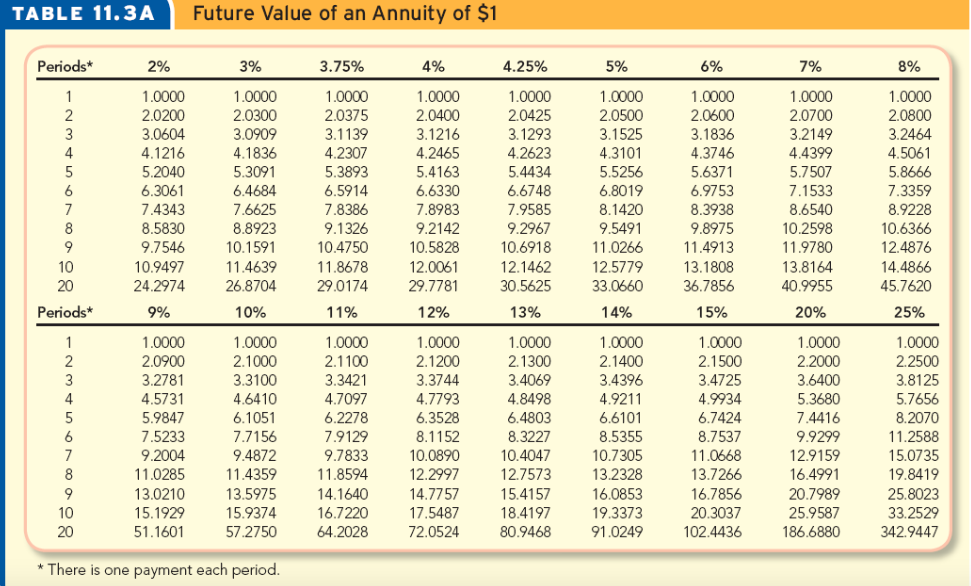

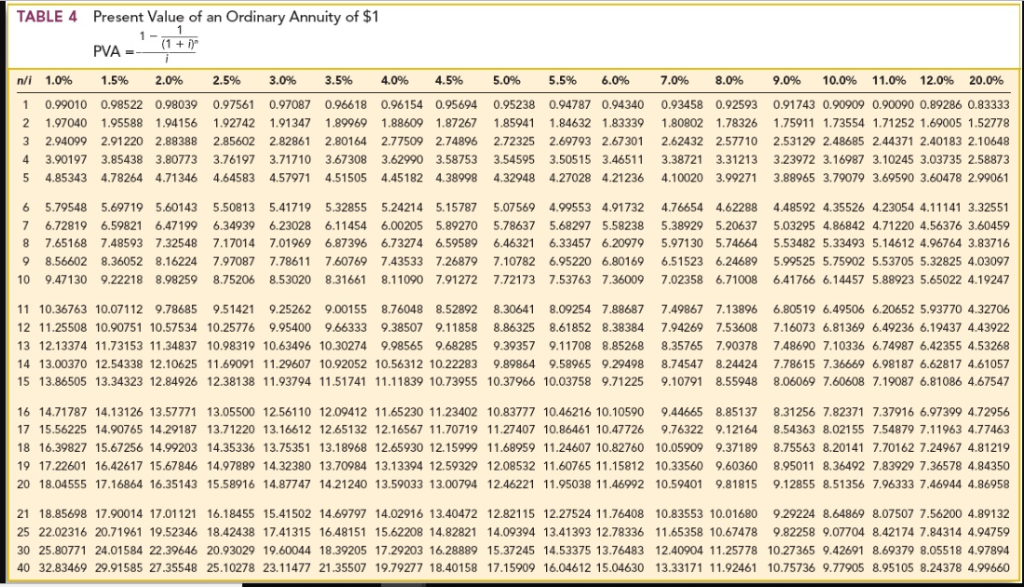

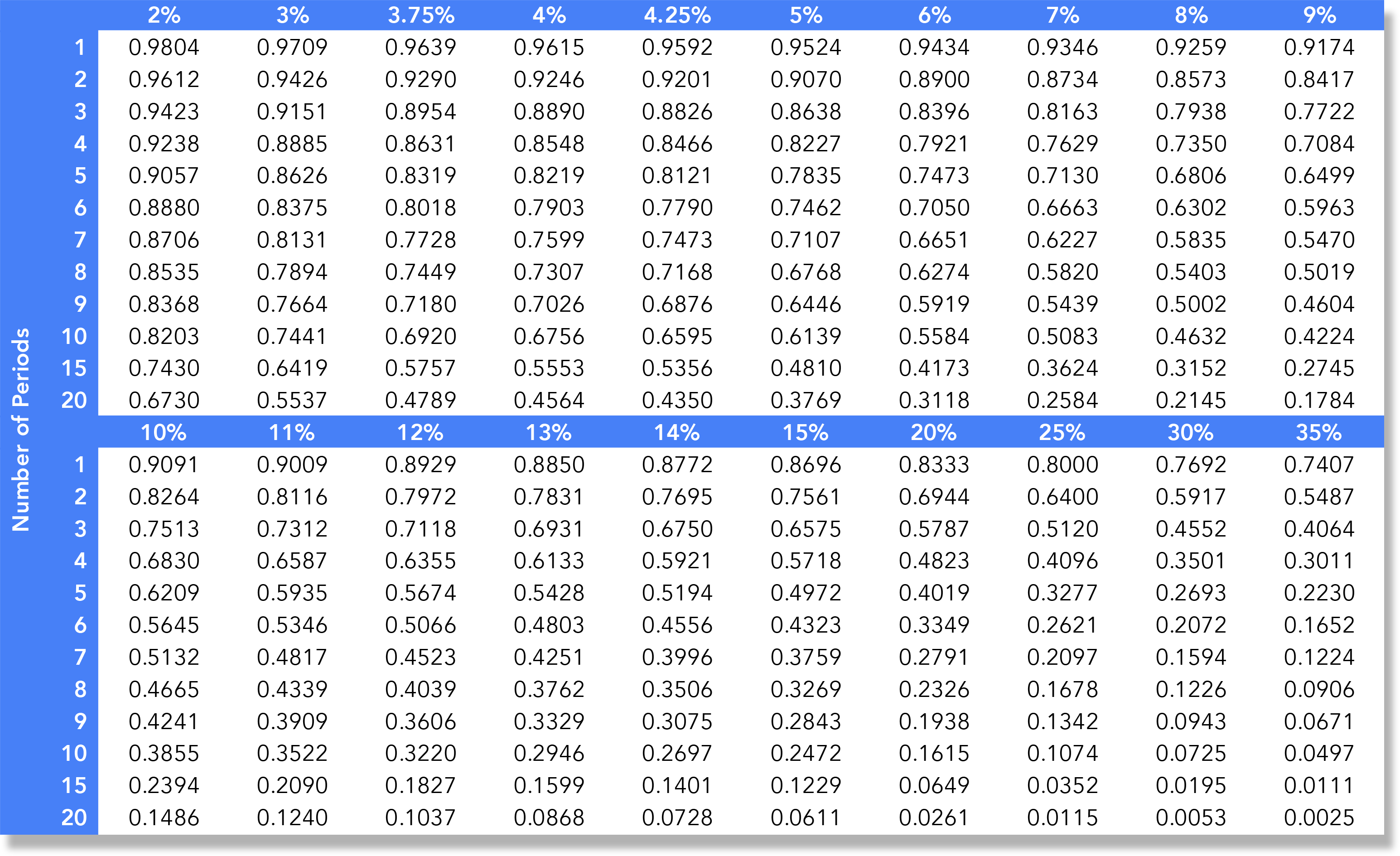

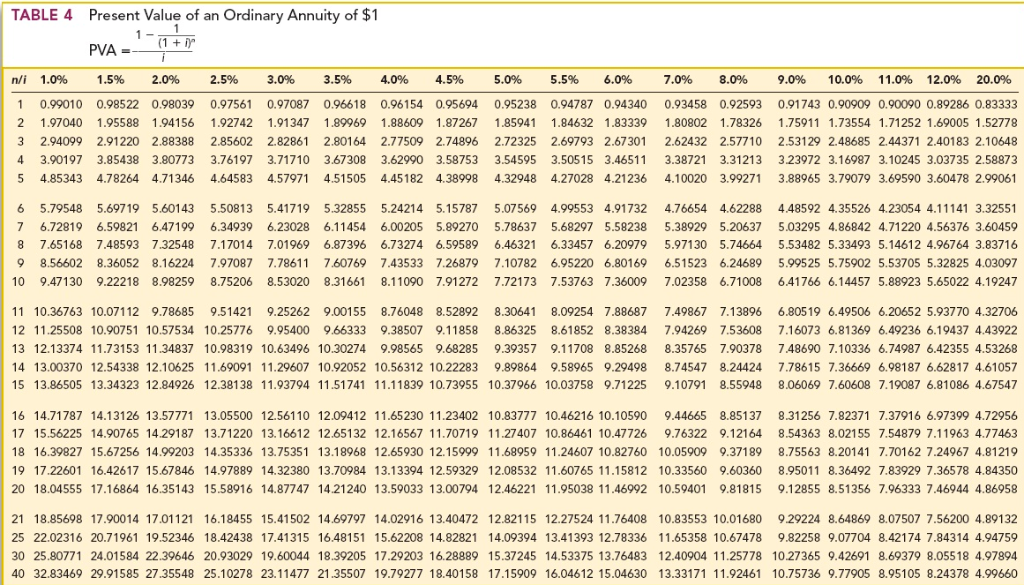

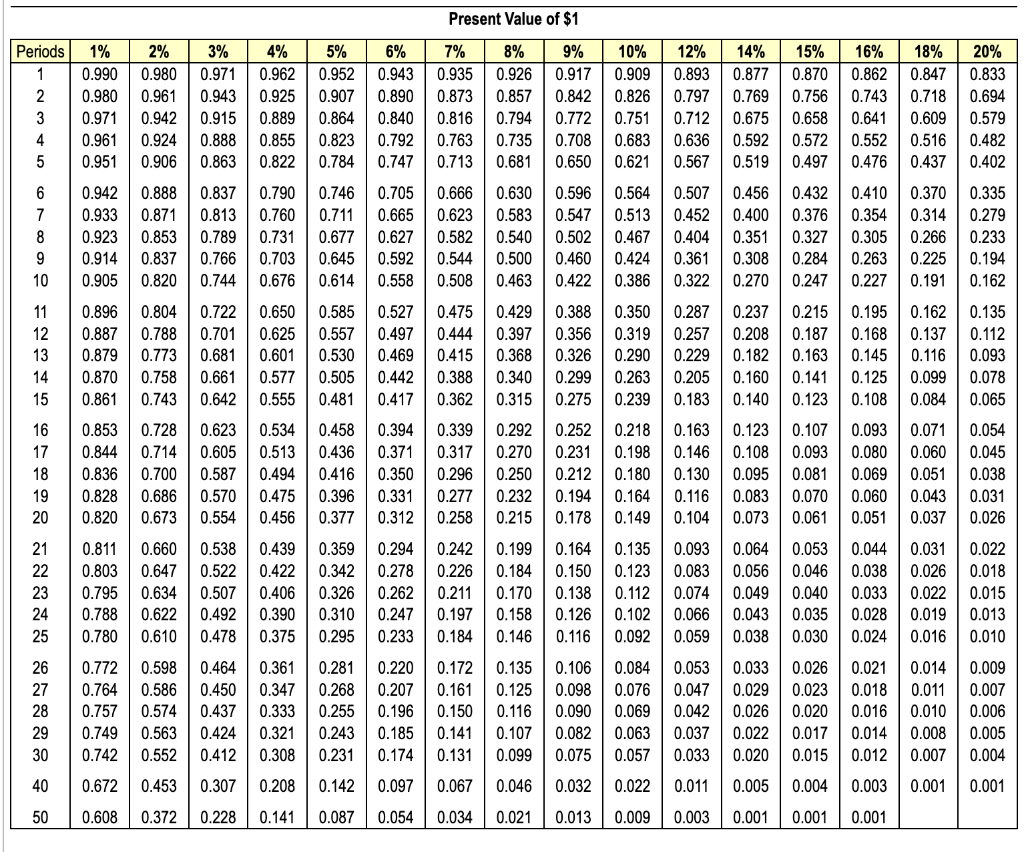

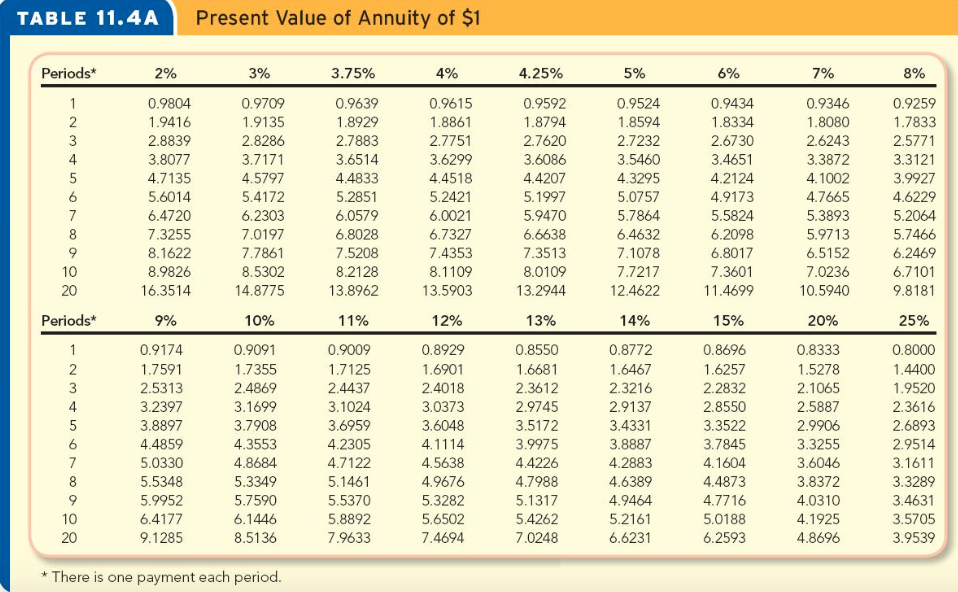

Present value of annuity table of $1

Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by David is 20882 and 20624 in case the payments are received at the start or at the end of each quarter respectively. What is the present value of 84253 to be received or paid in 5 years discounted at 11 by table and factor formula.

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

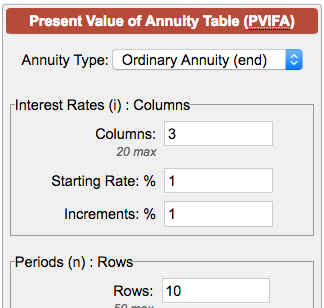

Create a table of present value interest factors for an annuity for 1 one dollar based on compounding interest calculations.

. The program uses this value to calculate the annuity payout the present value of the annuity payments and the present value of the remainder for gift tax purposes. The present value interest factor of annuity PVIFA is a factor which can be used to calculate the present value of a series of annuities. It is shown below.

What is the present value of a 4-year annuity if the annual interest is 5 and the. Use 1 for type. Go to Table 1.

Along with our writing editing and proofreading skills we ensure you get real value for your money hence the reason we add these extra features to our homework help service at no extra cost. Check it out on the IRS web site. Go to a present value of 1 table and locate the present value of the bonds face amount.

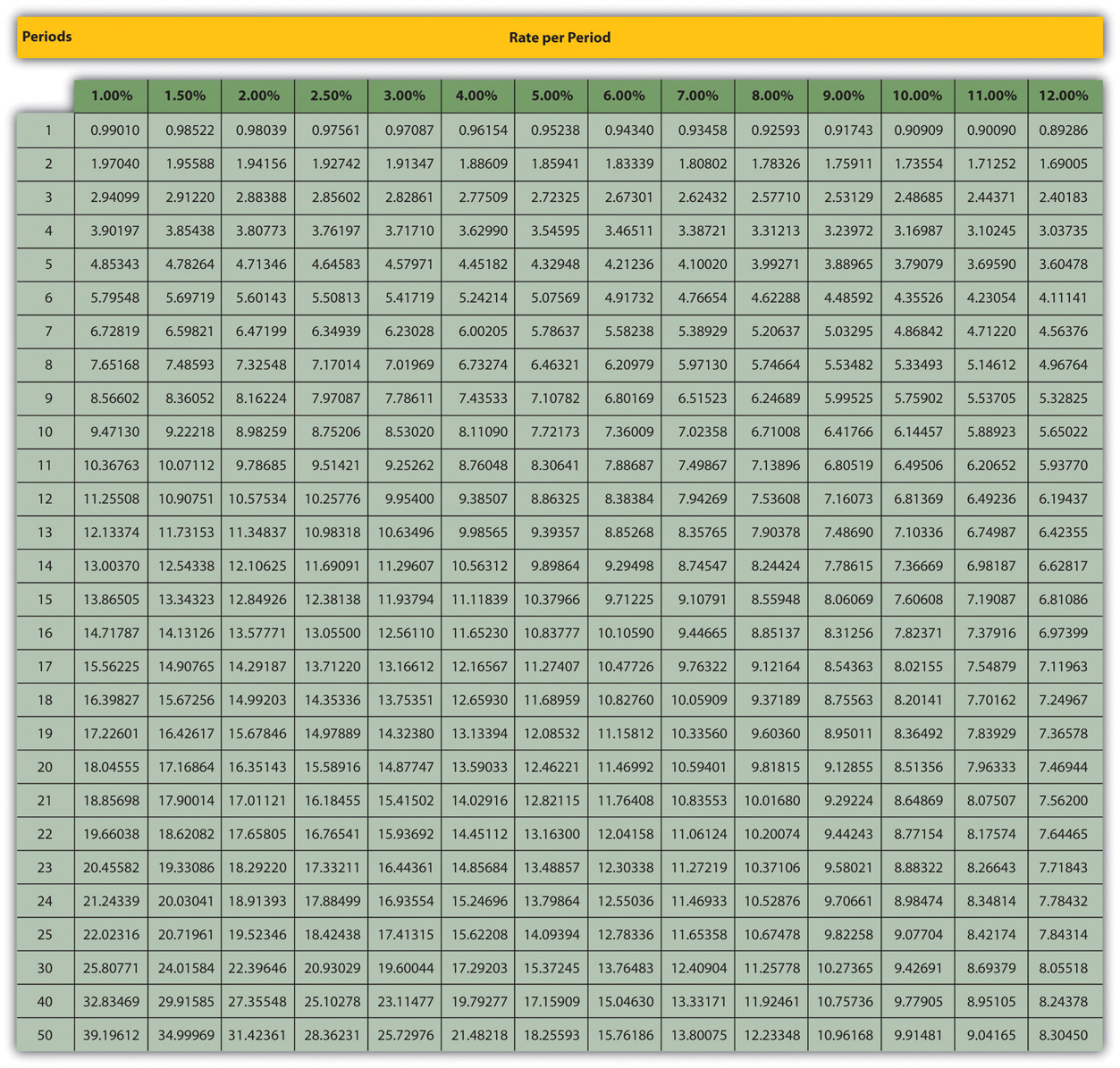

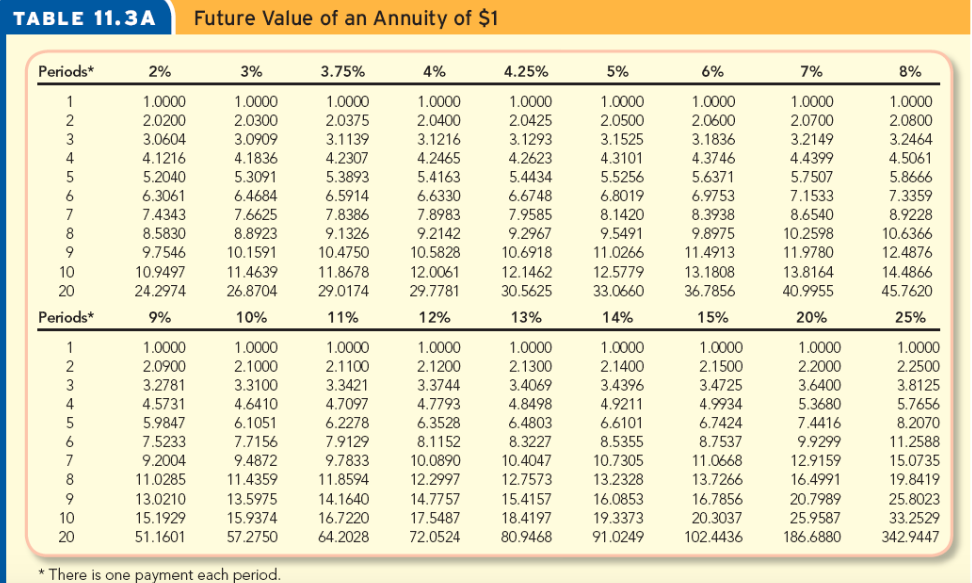

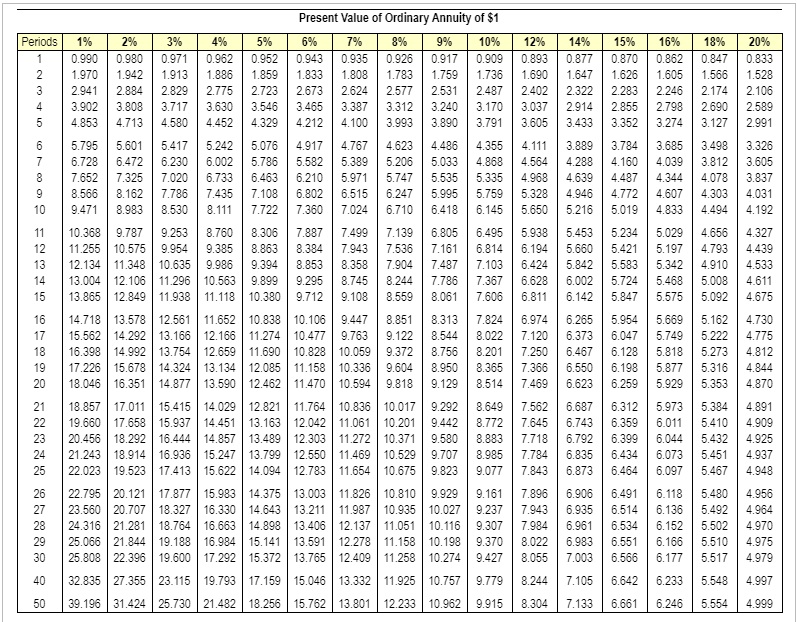

Notice that the projects in the above examples generate equal cash inflow in all the periods the cost saving in example 2 has been treated as cash inflow. Present Value of an Ordinary Annuity or Present Value of an Annuity Due Table. Present Value of 1 Annuity Table PVIFA Present Value of 1 Table PVIF Present Value Formula Derivations.

NPV Net Present Value Formula Example 2. Allocation based on fair market value of product at export terminal. Enter the premiums.

2 Use of present value of 1 table. Multiply line 4 by line 5. What should be paid for this investment if the target rate of return is 10.

For more information see section 1863-1b of the regulations. Let us take the example of David who seeks to a certain amount of money today such that after 4 years he can withdraw 3000. Use the PV of 1 Table to find the rounded present value figure at the intersection of n 12 3 years x 4 quarters and i 2 8 per year 4.

Summary of Source Rules for Income of Nonresident Aliens. Add together the two present value figures to arrive at the present value of the bond. In formula terms this would be 11i n.

He instantly goes and invests his dollar in government security today say 4. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. Published by Harry Vance on 12112021 See all author posts.

This could be done one at a time but this might be tedious. Value from present value of an annuity of 1 in arrears table. By default this value is the same as the Pre-discounted Fair Market Value.

Calculate the amount that David is required to deposit today. Go to a present value of an ordinary annuity. Net present value method with uneven cash flow.

Present Value Example 2. General Electric has the opportunity to invest in 2 projects. Using your age on the last day of the tax year find your age group in the left column and enter the cost from the column on the right for your age group.

Present Value 2000 1 4 3. How much is the payment worth then. Fist off when you retire roll the 401k to an IRA.

The present value of this annuity is equal to 20198. For example George earned 1 today. Present Value Interest Factor Of Annuity - PVIFA.

Enter the number of full months of coverage at this cost. In this case it is 98686 which is calculated as the 74730 bond present value. PVIFA 11i 11i2.

Instead we have to multiply the payment value by the PVIFA. For ordinary annuity where all payments are made at the end of a period use 0 for type. The time value of money TVM is the idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

Time Value of Money - TVM. Conversely the present value of a dollar one year later is definitely less than one dollar. The present value of each of the cash flows is the value of the annuity.

Perhaps one is considering buying an investment that returns 5000 per year for five years with the first payment to be received immediately. But the bottom line is you CAN tap 401k IRA money before 59 12 without. In this case the present value factor.

Alternatively we can compute the present value using the factor from present value of 1 table. At the end of the year he increases the future value of its dollar one year later by earning interest on that ie 104. Project A requires an investment of 1 mn which will give a return of 300000 each year for 5 years.

Number of periods n 4 and Interest rate i 10 or 01 3415 The factor from present value of 1 table. Present value intra-year discounting. The total value of these eight payments will not be equal to simply 8 3000.

Then do a substantially equal distribution from the IRA. Now we know that every 1 you receive is on average worth 673 times more in present value - that is 673. Multiply line 6 by line 7.

Such a flow of cash is known as even cash flow. All the days you were present in 2021 1 3 of the days you were present in 2020 and. Present value of an annuity.

Present value of a 1 ordinary annuity or 1 annuity due. Present value calculations are applicable to annuities also. How to mathematically derive present value formulas for a future sum annuity growing annuity perpetuity with continuous compounding.

Section 417e3A generally provides that for purposes of 417e1 and e2 the present value is not permitted to be less than the present value calculated by using the applicable mortality table and the applicable interest rate as defined in 417e3B and C. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. Annuity Present Value Interest Factor.

Calculation Using a PV of 1 Table The present value of receiving 5000 at the end of three years when the interest rate is compounded quarterly requires that n and i be stated in quarters. One formula is based on your age another is like an annuity and I forget off the top of my head what the 3rd formula is. The applicable discount rate is 5 to be compounded half yearly.

The mortality factors from Table 80CNSMT Table 90CM or Table 2000CM are also used if the interests. Apart from the various areas of finance that present value analysis is used the formula is also used as a component of other financial formulas. A list of present value formulas for a future sum annuity growing annuity.

Future Value of Annuity Problems.

Solved Table 6 Present Value Of An Annuity Due Of 1 1 I Chegg Com

Appendix Present Value Tables Financial Accounting

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

2

Present Value Of An Ordinary Annuity Of 1 Download Table

Present Value Factor Tables Acct 1

Table 4 Present Value Of An Ordinary Annuity Of 1 Chegg Com

Present Value Of Ordinary Annuity Table Accountingexplanation Com

Present Value Of 1 Annuity Table

Solved Interest Rates Determine The Present Value Of Future Chegg Com

Present Value Of An Ordinary Annuity Of 1 Download Table

Solved Table 1 Future Value Of 1 Fv 1 1 I N Table 3 Chegg Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Present Value Of 1 Table Accountingexplanation Com

Future Value Of 1 Table Accountingexplanation Com

15 5 Time Value Of Money Business Libretexts

Solved The Present Value Of 1 Table The Present Value Chegg Com